Hello there !!

What is the reaction of the world to the Narendra Modi’s government shock move to scrap Rs. 500 and Rs. 1000 notes? Some of the reactions are extremely positive and the others negative and sobering.

As per a “BBC” report by Justin Rowlatt, Mr Bill Gates is extremely positive to the move. Bill Gates have given up control of Microsoft almost a decade ago. He and his wife now work full time with The Bill & Melinda Gates Foundation, the richest charitable organization in the world, which he set up back in 2000 and into which he has now poured more than $39bn (£31bn) of his fortune.The aim of the foundation is to reduce poverty and ill-health around the world, and India is an important focus for its efforts. Since 2010, the foundation has invested more than $1bn (£800m) in India, more than in any other country outside the US.

The article says Mr Bill Gates believes, India is on the verge of a digital financial revolution that goes well beyond the online payments and plastic cards that most banks already offer their customers. Gates is looking forward to the entry of players such as mobile phone companies and others into the consumer finance market - something the Modi government has said it is poised to authorise. These services use software first developed in Africa to transform your mobile phone into a kind of digital bank branch, allowing you to pay for goods and services, transfer money and even get loans at the push of key. Bill Gates also praised the implementation of GST.

Another article by “BBC” titled “How India’s currency ban is hurting the poor” gives a balanced view of the problems faced by common people and the problems small businessmen were facing with the sudden paucity of cash.

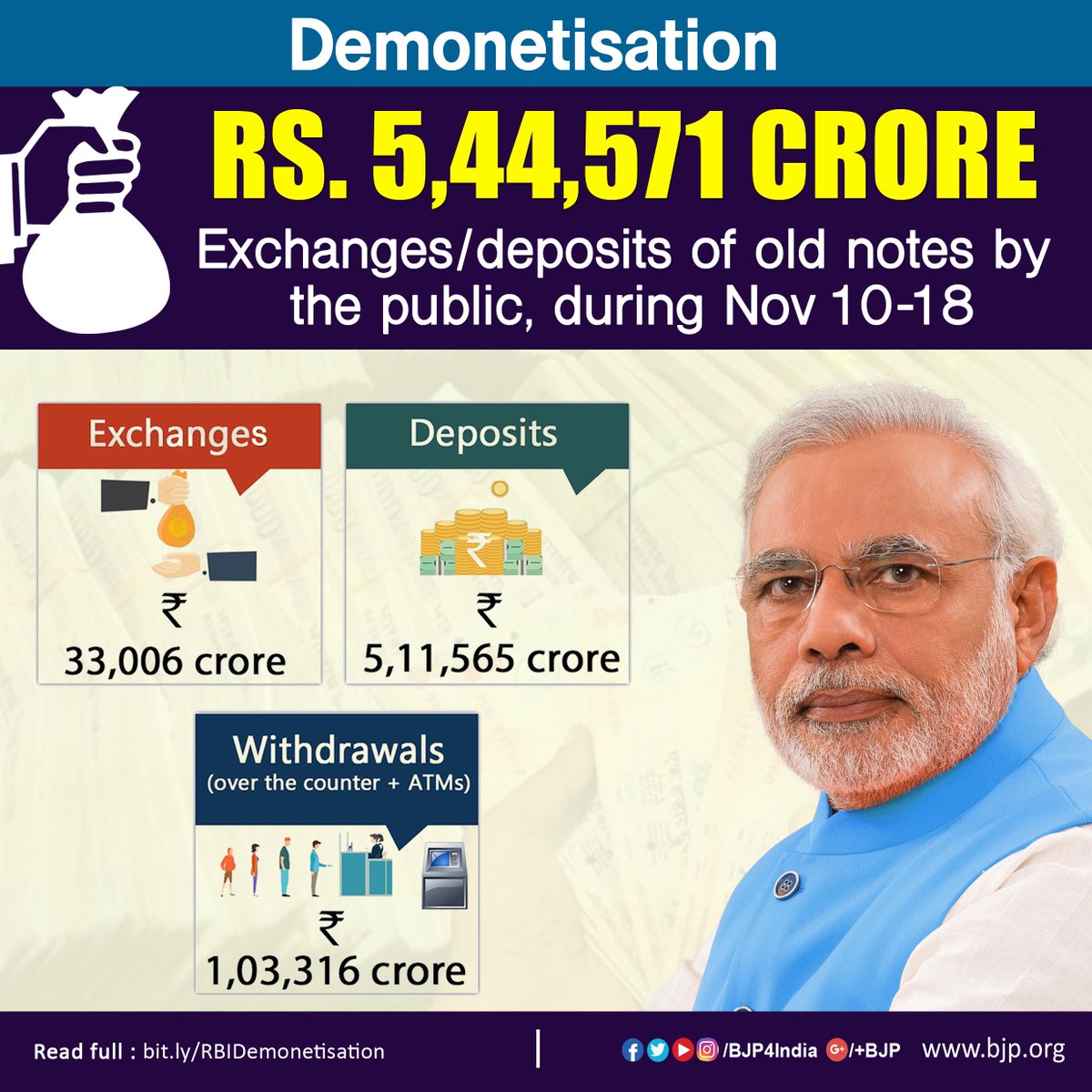

As per an article by “Forbes” published five days after the decision, titled “India’s Great Bank Note Switch Appears To Be Working – $30 Billion In Rs Deposited In Banks.” The article notes that a move of this magnitude would result in “obvious chaos”, but points that “so far at least it looks as if it is working.” The article goes on to call the scheme “rather well done, a clever plan.”

In another article in “Forbes India”, HSBC India’s chief executive Stuart Milne lauded Prime Minister Narendra Modi’s move to demonetize the pre-existing stock of Rs 500 and Rs 1000 currency notes. The article quoted Stuart Milne as “Leaving aside execution challenges, demonetization is a fantastic move. Part of the government’s move is to capture black money, but part of the move is to widen the tax net. It is important because the government’s long-term objective is to reduce the tax rate,”

"That will be a long term positive for the economy and promote investment.” Milne however, warned of a negative short-term impact in terms of a slowdown in consumption, till the availability of cash improves. “That will have an impact on GDP.”

As per an article in “The Independent,” the move is reminiscent of the step taken by Lee Kuan Yew who was the Singaporean Prime Minister for several decades and is considered the architect of modern Singapore. In a positive article titled “Modi does a Lee Kuan Yew to stamp out corruption in India, ” the magazine is all praise for the move. The article said a new Lee Kuan Yew is born in India. It will be reflected in the legacy of this Prime Minister.

“Time” magazine in an article titled “Saddled with worthless pieces of paper, ordinary Indians are finding it tough to purchase essential goods. Across India, patience is rapidly wearing thin” gives a sobering account of the huge Indian middle class and lower middle class standing in queues to exchange money and carry out their day to day life.

An article published in leading American financial journal “Bloomberg” quoted Swiss global financial services company UBS Group AG saying that Australia should follow India’s lead and scrap its biggest bank notes. It quoted UBS analysts led by Jonathan Mott who said in a note to clients on Monday, “Removing large denomination notes in Australia would be good for the economy and good for the banks,” “Benefits would include reduced crime and welfare fraud, increased tax revenue and a “spike” in bank deposits.”

Another article in “Bloomberg” titled “ Modi May Need Six More Months to Replace India’s Junk Bills” goes on to say that Prime Minister Narendra Modi’s administration may need until May 2017 to replenish the stock of now worthless bills .It quoted Saumitra Chaudhuri, an economist who published a blog post on the “Economic Times” website . Economist Chaudhuri reached his conclusion, by extrapolating from central bank data, and estimated that PM Modi’s move sucked out about 16.6 billion notes of the 500-denomination, and 6.7 billion 1,000-rupee bills meaning that more than 23 billion notes totaling 15 trillion rupees have been taken out, and replenishing this will take time, up to May 2017.

Source Bloomberg. Extrapolation by Saumitra Chaudhuri.Economist.

In an article in the famous “New York Times”, crowds at ATMs was shown and it also quoted an expert saying it was a wise move. It said, “The plan, top secret until Mr. Modi’s announcement, was hailed by financial analysts as bold and potentially transformational for India. It is also a high-stakes experiment,” the article said.

An article in the “Washington Post reacted in a positive manner. It called PM Narendra Modi’s initiative as ‘ambitious’ and in keeping with his election time vow to initiate a crackdown against black money. The Post said black money in India ‘is estimated to total from$400 billion to more than $1 trillion’.

The mouthpiece of the Chinese government “Global Times” labeled India's demonetization move as "startling and bold" which demonstrated Modi's determination to fight black money and corruption. But it opined that demonetization couldn't be counted upon to root out corruption and advised Narendra Modi to borrow ideas from China's crackdown in which millions of officials were penalized. It added that barring circulation of 'large currency bills' simply wasn't effective enough.

An article in the “The Diplomat” titled “The Trouble With India’s Demonetization Gamble, The country is in uproar following the bold and risky move” states that, the chief ministers of the states of Bihar, Andhra Pradesh, Odisha, and Telangana have openly expressed both support and appreciation for this move in the long run, while the chief ministers of Uttar Pradesh, Karnataka, Maharashtra, and West Bengal have expressed varying degrees of criticism and worry at the potentially very harmful short term impacts. Members of the Congress and the Samajwadi Party have violently opposed this move as well. The article lays down the problems it caused in all sphere of life in India and laid bare the facts.

IMF, European Union, World Bank and every reputed international organisations supported this move, World bank president even said, I am a big fan of Modi!