Hello there !!

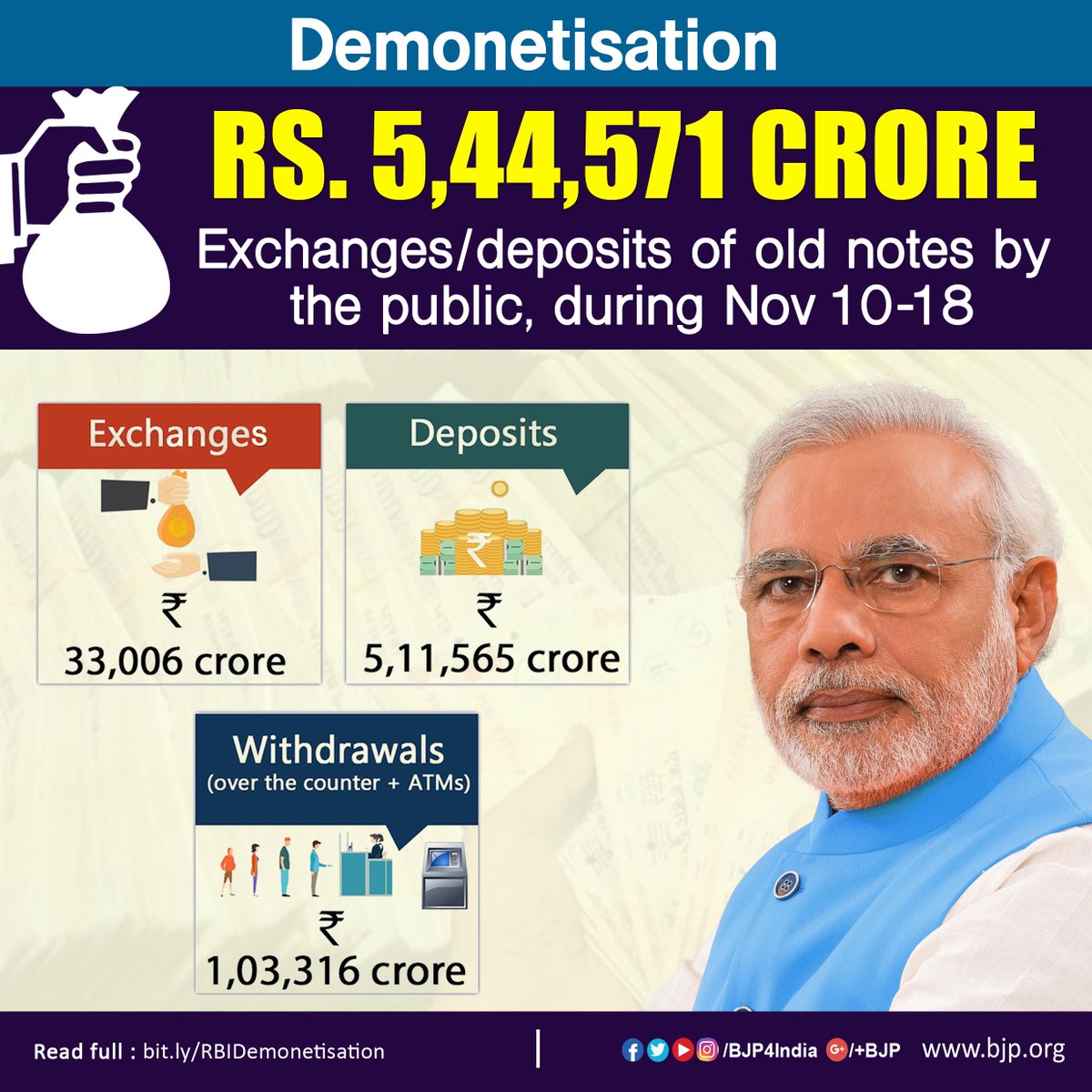

Here is an update on the demonetization drive being carried out and the changes in rules.

After nearly two weeks since Prime Minister Narendra Modi announced a ban on Rs500 and Rs1,000 currency notes to fight black money, there has been a massive opposition backlash in the winter session of Parliament. Also, there has been changes in rules with the government trying to combat the monetary crisis and black money in real time.

Some of the key highlights as per various media reports are.

After the rush and panic at Banks, the government has made several exceptions allowing people to use invalid currency notes for buying petrol/diesel, rail and air tickets, payment of public utilities, taxes, and government hospitals. The government allowed farmers to purchase seeds for the rabi crops using old Rs 500 notes from government outlets or state, central agriculture university. This was done keeping in view the slowdown in farming. Also the RBI today provided additional 60 days for repayment of housing, car, farm and other loans worth up to Rs 1 crore.

Depositing their unaccounted old currency in someone else's bank account, carries a penalty, prosecution and rigorous jail term of a maximum seven years under the Benami Property transactions Act, 1988, applicable on both movable and immovable property, that has been enforced from November 1 this year.

Income tax department has detected over Rs 200 crore in undisclosed income after it conducted over 80 surveys and about 30 searches in cases of suspicious usage of the scrapped currency. About Rs 50 crore has also been seized in these operations since November 8, across various states.

The amount of old Rs500 and Rs1000 notes that can be exchanged at bank branches is reduced to Rs2,000 for one person from Rs4,500 starting Friday 18 Nov 2016.

People can withdraw up to Rs2.5 lakh for marriage purposes from bank account of one family member. A self-declaration that this facility will not be used by any other family member is to be submitted.

Farmers are allowed to withdraw up to Rs25,000 per week (Rs500 more than the limit for the general public) to help them in buying seeds and fertilizers on time.

Traders registered with APMC (agricultural produce market committee) can withdraw Rs50,000 per week to meet their immediate cash requirement.

Central government employees up to Group C can withdraw advance salary of Rs10,000 that will be adjusted from their November salary. All charges on all ATM transactions till 30 December is being waived off.

All cash deposits above Rs50,000 in a day and those that aggregate to more than Rs2.5 lakh during 9 November-30 December will be required to quote PAN. This is keep track of such deposits and to ensure that tax evaders do not use the poor to legalize their illicit wealth. A common practice at present by Tax evaders is to get away by making multiple deposits of less than Rs50,000 without providing their PAN .

On Thursday RBI allowed foreign investors to buy securitised debt, which refers to securities such as mortgages structured by issuers, as part of efforts to attract more flows into debt markets., The RBI also waived a rule that requires foreign investors to invest only in debt with at least three years in remaining maturity for securitised debt investments.

The government has taken a number of measures to ensure tax evaders do not go scot-free they are conducting surveys on jewelers and money launderers and are using indelible ink to prevent the same people from lining up multiple times to exchange old currency.

All Banks and post offices will be required to report all deposits exceeding Rs2.5 lakh in the annual information return (AIR) sent to investigative agencies, as against the current ceiling of Rs10 lakh being part of the changes that have been notified by the I-T department after demonetization.

A new clause on deposits in current accounts has also been introduced, wherein cash deposits of more than Rs12.5 lakh will have to be reported by a bank. This will help the tax department seek an explanation from depositors. All AIR transactions get included in Form 26AS and by including cash deposits of the specified period the income-tax department has closed another loophole.

| Infographic by India today.in |

A comman man's reaction on #DeMonetisation in Kolkata pic.twitter.com/B47AaOB1Tt— Rishi Bagree (@rishibagree) November 21, 2016

No comments:

Post a Comment